Third plenum draws up sweeping reform blueprint to advance Chinese modernization

The 20th Central Committee of the Communist Party of China (CPC) adopted a resolution on further deepening reform comprehensively to advance Chinese modernization at its third plenary session, drawing up a sweeping blueprint that will guide China's reform and opening-up for years to come, according to a communique released on Thursday.

The communique was released following the completion of the third plenary session, which was held in Beijing from Monday to Thursday.

General Secretary of the CPC Central Committee Xi Jinping delivered important addresses. At the session, the Central Committee heard and discussed a report on the work of the Political Bureau, presented by Xi on behalf of the Political Bureau, according to the communique.

Amid a complex international and domestic situation, many in China and around the world have been closely following the reform-themed session, which is often referred to as the "third plenum."

Over the past four decades or so, the "third plenums" have played critical roles in China's economic miracle.

This edition of the third plenum not only reaffirmed China's unwavering commitment to reform and opening-up, but also drew a clear path for China's continuous high-quality development, which helps boost confidence both at home and abroad, experts said.

For the world, China's deepening reform and expanding opening-up will create greater opportunities amid a global economic downturn and rising economic protectionism, and China's high-quality development will help create a new type of international relations based on the principles of equality and mutual respect, foreign experts said.

Clear path

In line with decades of tradition, the third plenary session of the 20th CPC Central Committee also focused on mapping out reform and opening-up plans. Noting that the present and the near future constitute a critical period for China's endeavor to build a great country and move toward national rejuvenation on all fronts through Chinese modernization, the session further elevated the importance of reform for the country and stressed the advancing of Chinese modernization.

"Chinese modernization has been advanced continuously through reform and opening-up, and it will surely embrace broader horizons through further reform and opening-up," the communique said. "We must purposefully give more prominence to reform and further deepen reform comprehensively with a view to advancing Chinese modernization in order to better deal with the complex developments both at home and abroad."

The reform tasks laid out in the resolution covered a wide range of areas from the economy and whole-process people's democracy to ecological conservation and national security, according to the communique.

Economic reform, in particular, was a main focus. The third plenum said that China will build a high-standard socialist market economy in all respects by 2035. In building a high-standard socialist market economy, the role of the market must be better leveraged, with a fairer and more dynamic market environment to be fostered and resource allocation to be made as efficient and productive as possible.

Various reforms will also be carried out to promote high-quality development, including deepening supply-side structural reform. Institutions and mechanisms will also be improved to foster new quality productive forces in line with local conditions. Reform tasks were also laid out for macroeconomic governance and key areas such as finance and taxation.

Li Daokui, director of Tsinghua University's Academic Center for Chinese Economic Practice and Thinking, said that the third plenary session not only lays out a clear path for reform in the coming years, but also reaffirmed China's commitment to reform and opening-up.

"The communique put emphasis on both reform and opening-up and reaffirmed upholding the basic national policy of opening-up, which I believe offers further reassurance for foreign businesses and investors," Li told the Global Times on Thursday.

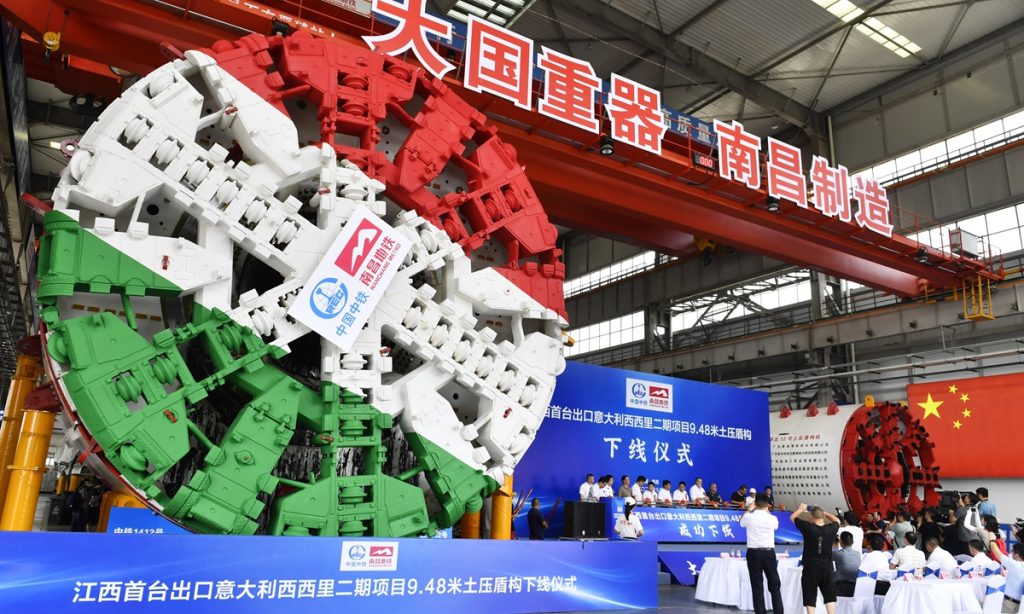

Describing opening-up as a "defining feature of Chinese modernization," the communique said that the Party will "steadily expand institutional opening-up, deepen foreign trade structural reform, further reform the management systems for inward and outward investment, improve planning for regional opening-up, and refine the mechanisms for high-quality cooperation under the Belt and Road Initiative."

Among the highlights of the reform tasks, Li pointed to the various reform measures to ensure and enhance the people's well-being, including improving the income distribution system and the employment-first policy, which will help address the direct concerns of the people. The reform plan for building a high-standard socialist market economy is also of great significance, as it will help create a fairer and more dynamic market environment, Li said.

Boosting confidence

The sweeping reform plan laid out by the third plenum will have profound significance for both China and the world, and will help boost confidence amid rising risks and challenges for the world as a whole, Chinese and foreign experts said.

"The reform tasks are critical in shaping China's economic development and its position on the global stage," Lian Ping, director of the China Chief Economist Forum, told the Global Times on Thursday. "The success of these reforms will directly affect whether China's economy can continue to rise in the next 10 years and beyond."

While China's economy has maintained stable growth in recent years despite a global downturn, it faces a growing set of risks and challenges, including rising economic protectionism and geopolitical tensions. The reform measures are key to tackling these challenges and ensuring China's continuous high-quality development, experts said.

"The goal of reform is to address long-standing problems and improve systems to remove hurdles for continued economic growth," Lian said.

The communique also said that the overall objectives of further deepening reform comprehensively are to continue improving and developing the system of socialism with Chinese characteristics and modernize China's system and capacity for governance.

This also reflects the effectiveness and importance of the CPC's leadership, according to Alexander Lomanov, deputy director for scientific work at the Primakov National Research Institute of World Economy and International Relations, Russian Academy of Sciences (Moscow).

"The CPC's ability to correctly assess the situation in the economy, proceed from the interests of the people, and defend these interests with all its strength is particularly important," Lomanov told the Global Times. "The top-level design in economic policy, which only the CPC leadership can provide, is very important."

The CPC's leadership is the source of confidence in China's economic development both in the short term and in the long run, experts said.

The third plenum not only mapped out reform tasks to ensure long-term high-quality development, but also conducted an analysis of the present situation and the tasks the Party faces, and urged firm commitment to accomplishing the goals for this year's economic and social development, according to the communique.

Li said that the content suggests that more measures will be rolled out for the second half of 2024, especially in terms of expanding domestic demand, so as to ensure that the annual growth target will be met.

"This is a very important message for the world," Li noted.

Chinese modernization and China's continued high-quality development are also of great significance for the trend of multipolarization of the world, said Lomanov.

"China's economic development creates favorable prerequisites for the creation of a new type of international relations based on the principles of equality and mutual respect, free from intimidation and pressure," Lomanov said.

The communique stressed that Chinese modernization is the modernization of peaceful development. "In foreign relations, China remains firmly committed to pursuing an independent foreign policy of peace and is dedicated to promoting a human community with a shared future," it noted.